The maturity mismatch between long-term assets and short-term liabilities expose banks and financial corporations to interest rate risk. Angbazo (1997) states that maturities mismatch pushes the risk premium up due to volatility in short-term interest rates. Meanwhile, Gambacorta (2008) asserts that the maturity discrepancy between assets and liabilities exert pressure on bank profitability and lead to elevated levels of risk premium. Moreover, it is a well-known fact that maturity mismatch affect financial conditions through liquidity. Radelet and Sachs (1998) argue that excessive dependence on short-term assets fuels liquidity shortages in emerging markets and thus lead to increased financial fragility.

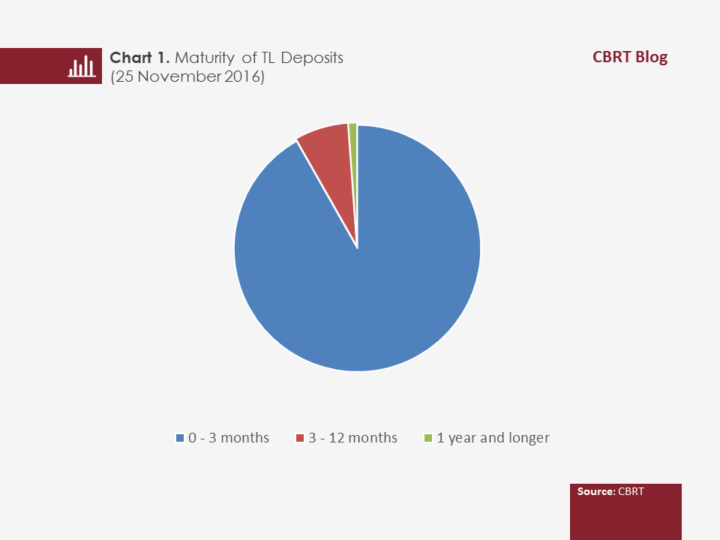

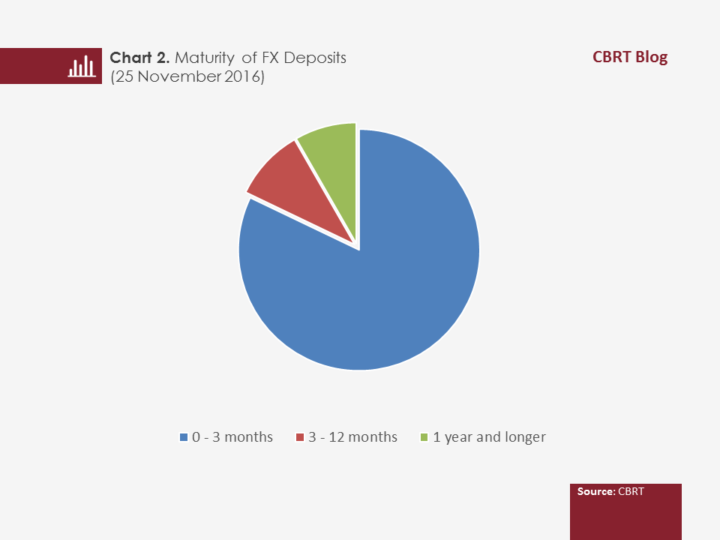

An analysis of the maturity structure of deposit accounts in Turkey reveals that the majority of the TL and FX deposit accounts have maturities of three months (Chart 1). By 25 November 2016, TL deposit accounts with maturities up to 1 month and 3 months constituted 73 percent of total deposits; while FX deposits in the same maturity bracket made up 62 percent of total deposits. The share of TL deposits with maturities of 1 year and longer in total TL deposits is below 1.5 percent. Given the increased risk premium, the current maturity structure in Turkey brings about tightening in financial conditions.

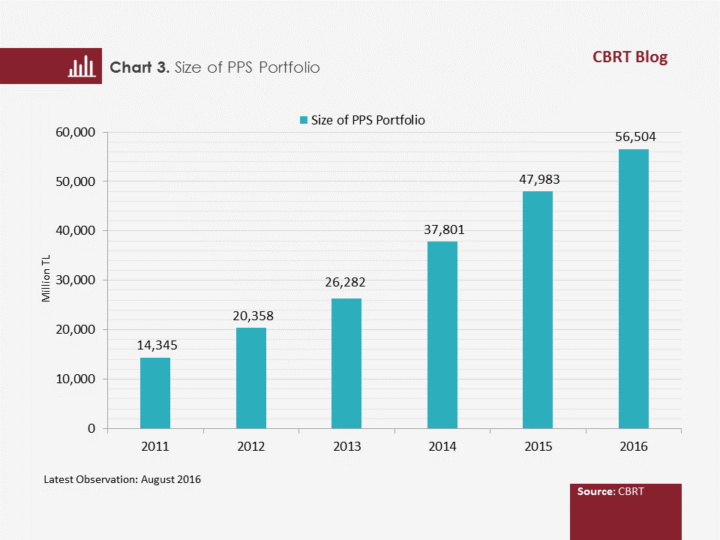

The Private Pension System (PPS), which reached TL 57 billion over the last few years, did not only help register small savings but also contributed to raising the funds necessary for deepening and broadening of the financial system. In other words, while on the one hand, PPS increases the welfare level of individuals with the additional income they will enjoy during retirement, on the other hand it contributes to financial stability.

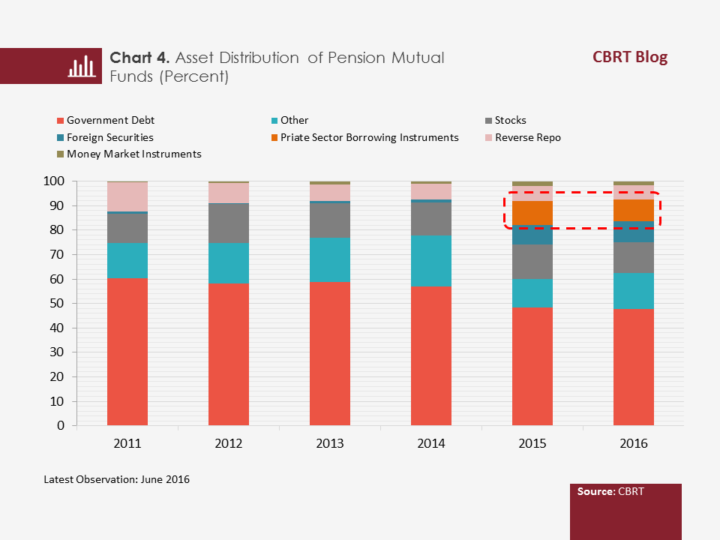

Via the PPS, long-term and regular funds are flowing to the financial markets and these funds are mostly used to make investments in capital markets. This alleviates the volatility of short-term capital movements and strengthens market resistance to financial crises (Can, 2010, Beetsma and Vos, 2016). As illustrated in Chart 4, the share of private sector borrowing instruments in the PPS funds has increased in Turkey. This is an important indicator of the contribution that pension funds make to the deepening in capital markets.

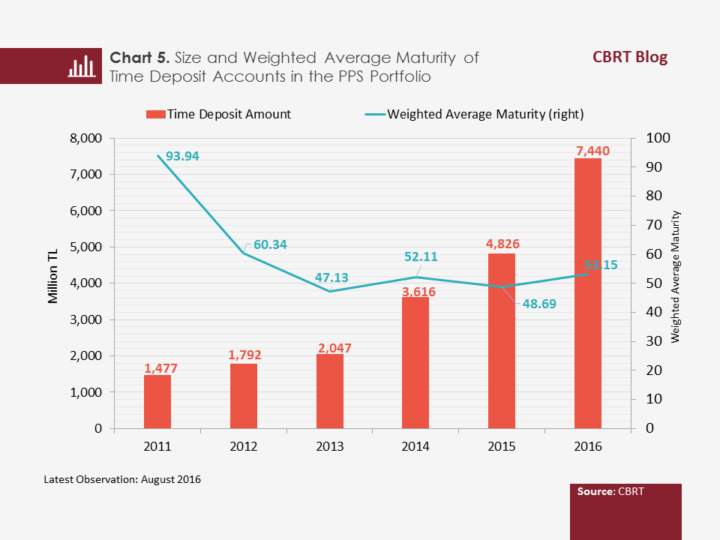

In terms of financing investments, the longer the maturity of pension funds, the lower the risk premium and the lower the cost of borrowing. Nevertheless, it is observed that the deposits made by the PPS have a fairly short maturity of 53 days. The short maturity structure of pension funds in Turkey limits the availability of low-cost financing to the economy.

All the evaluations mentioned so far indicate that the private pension funds in Turkey have the potential to provide more contribution to extending deposit maturities in the Turkish banking system. The regulation regarding the principles of incorporation and activities of PPS [1] funds published in Official Gazette dated 13 March 2013 stipulates no limitation on deposit / participation accounts of pension funds but the maximum maturity of mutual funds were set as 12 months. Introduction of a minimum maturity implementation for deposit accounts may help extend the deposit maturities in the Turkish banking sector. The likely liquidity shortages that may stem from this arrangement can be overcome by meeting the short-term liquidity needs of pension funds via reverse repo. Such an arrangement may have positive implications for fund owners as well, as extending the maturity of deposits in the portfolios of pension funds can provide additional term premium returns.

Footnotes:

[1] "Regulation on the Incorporation and Activities of Private Pension Funds" published in Official Gazette No: 28586, dated 13 March 2013- available only in Turkish

Bibliography:

Angbazo, L. (1997), “Commercial bank net interest margins, default risk, interest-rate risk, and off-balance sheet banking”, Journal of Banking & Finance 21:1, pp. 55-87.

Can, Y., (2010), "Private Pension Funds in Turkey", Ekonomi Bilimleri Dergisi, V.2, No.2 - available only in Turkish

Beetsma, R., Vos, S., (2016), “Stabilisers or Amplifiers: Pension Funds as a Source of Systemic Risk”, VOX, CEPR’s Policy Portal,

Gambacorta, L., (2008), “How do banks set interest rates?”, European Economic Review 52:5, pp. 792-819.

Radelet, S., Sachs, J. D., (1998), “The East Asian Financial Crisis: Diagnosis, Remedies, Prospects.” NBER Working Paper No. 6680.