Traditionally, households in Turkey meet most of their financing needs from banks. Households’ borrowing from other financing sources seems to be limited. Recently, the share of financing companies in household liabilities has increased owing to the moderate growth in bank loans and the opening of new financing companies.

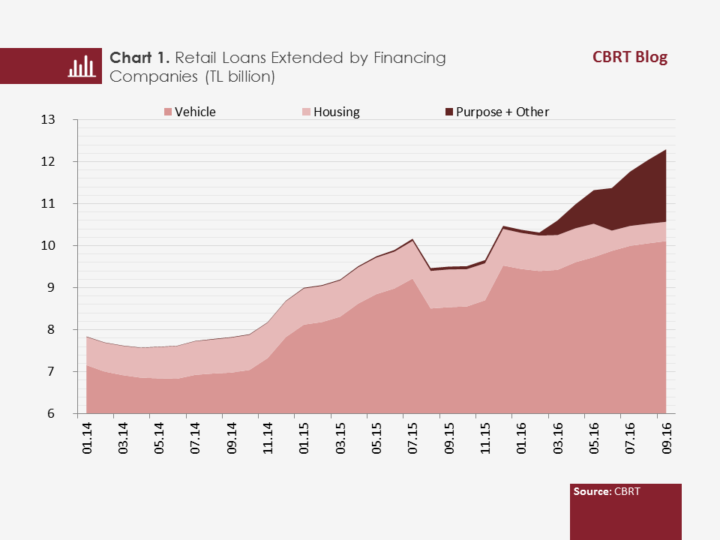

By 2016, there were 14 active financing companies. Financing companies' loan products are very similar to those of banks and they provide funds for various needs of households such as vehicles, housing, consumer durables and service sector. In September 2016, retail loans that households obtained from financing companies increased by 29.4 compared to the previous year and reached TL 12.3 billion.

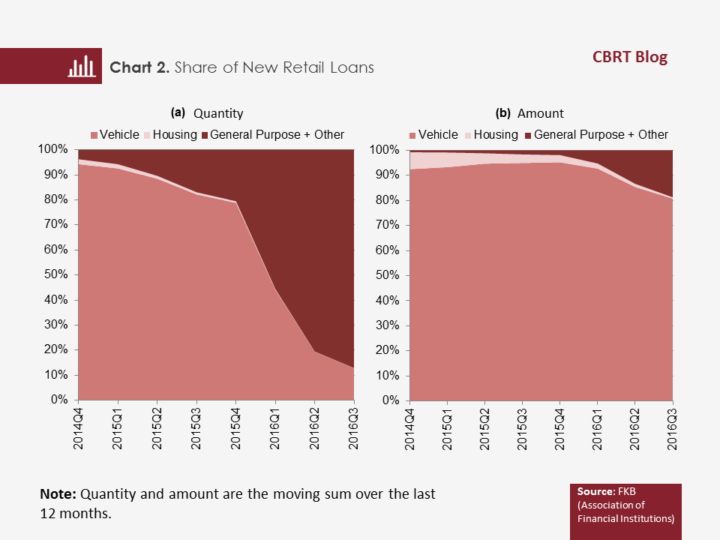

Financing company loans are widely used to finance installment payments for personal and commercial vehicle purchases. As a matter of fact, the amount of vehicle loans extended by financing companies has exceeded the amount of vehicle loans provided by banks starting from 2015. Recently, it is observed that households have been opting for financing companies for purchases when they need general purpose loans. By 2016, the number of new general purpose loans issued by financing companies over the last 12 months increased 33-fold year-on-year and reached a total number of 1.6 million. In this period, general purpose loans extended by financing companies constituted approximately 87 percent of the total retail loans in quantity and 19 percent in value.

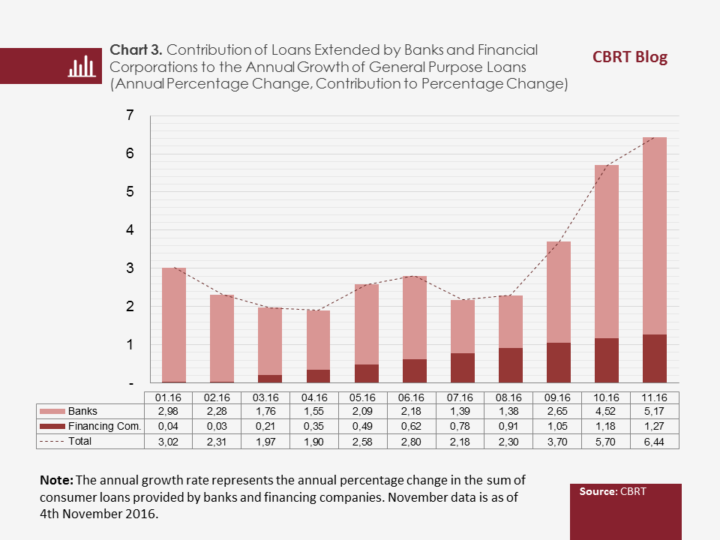

The different business model of the financing companies compared to banks paves the way for the increasing demand for their loans. Another factor pushing the demand for financing company loans is the installment limits imposed by the BRSA in 2013 on spending with credit cards. Financing companies’ accessibility to large sales networks allows consumers to have easy and on-site financing in a shorter time than general purpose loans provided by banks. Households prefer financing company loans in their spending particularly on technological products and durable goods. Therefore, the amount of general purpose loans extended by financing companies per borrower is significantly lower than those extended by banks. Despite the low level of loan balances, financing companies made a remarkable contribution to the general-purpose loan growth (both by banks and financing companies) For example, the contribution of financing companies to total general purpose loan growth, which grew by 5.7 percent in October 2016 compared to the previous year, was 1.2 percentage points. In other words, in this period, approximately 20 percent of the total general purpose loan growth came from financing companies.

Financing companies can contribute to financial stability by deepening the financial sector and increasing risk diversification. Similarly, financing companies are expected to increase the operational efficiency of the Turkish financial system via the competition channel in the loan market. Meanwhile, steps have been taken by regulatory authorities to prevent financing companies from executing shadow banking activities. The BRSA’s regulations on capital and provisions for financing companies prevent the emergence of regulatory arbitrage. Moreover, the CBRT’s decision to include financing companies in the reserve requirement starting from 2014 was a step taken towards achieving this objective. With the regulations introduced for financing companies, these companies are expected to function effectively and contribute to financial deepening. The financing companies, which achieved a quite competitive level in the vehicle loan market, are expected to get a significant share in the low-amount general purpose loan market.