In emerging economies, the exchange rate pass-through can be affected by factors such as the degree of openness of the economy, the inflation outlook, exchange rate volatility, the current account deficit and the direction and size of exchange rate movements. Moreover, the extent of the exchange rate pass-through to price indices can also vary across subcategories.[1] For example, the exchange rate pass-through to prices can be relatively lower for services products, non-tradable goods or products with relatively low import content than for other goods. As an example, Auer and Mehrotra (2014) found that the impact of the exchange rate depreciation on producer prices varied depending on the use of imported inputs in Asia Pacific countries. Therefore, analyzing the pass-through by using general price indices might mask some crucial information hidden in the details.

How do changes in import prices affect final prices then? There are two ways. The first is directly, that is, through imported final consumer goods included in the consumption basket. Here, increases in import prices are expected to fully pass through to product prices. The second way is indirectly, through production costs arising from the use of imported inputs in domestically produced products. Here, too, one expects the pass-through of an increase in import prices to producer prices to be proportional to the share of imported inputs in total production costs. However, the rate of price changes led by changing import prices might diverge from expectations due to market conditions and competition, and may differ across countries. For instance, in a study by Ahn et al. (2016), the pass-through of imported input price shocks to producer prices in Korea is lower than the share of imported inputs in costs, but is equal to that in European countries.

Scope of the Study

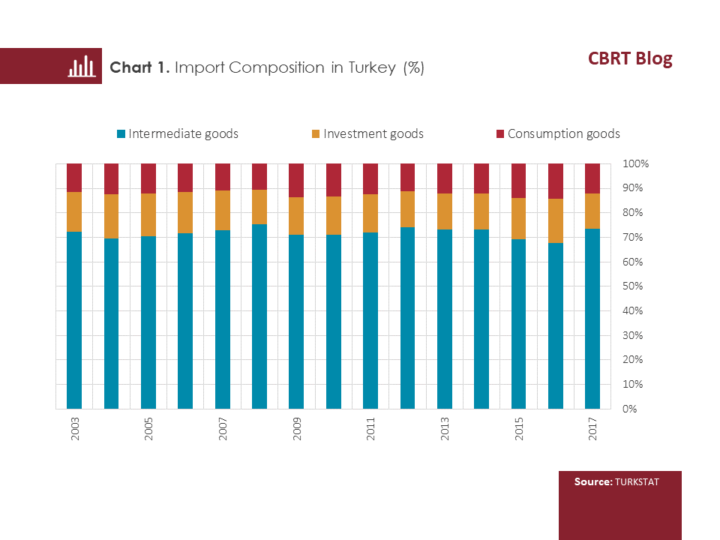

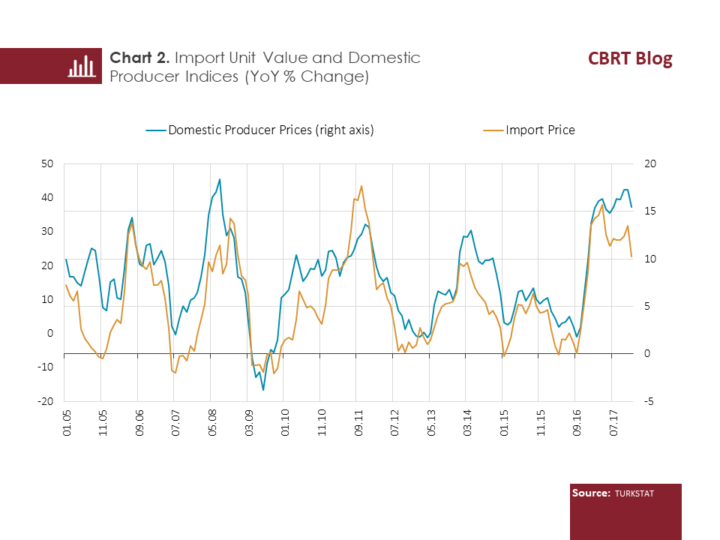

As of 2017, intermediate goods and consumer goods account for about 73 and 12 percent, respectively, of imported goods in Turkey. As shown in Chart 1, these percentages have remained relatively stable over time. Given this outlook, it seems more likely that import prices affect prices in Turkey through the cost channel. This view is confirmed by the visual relationship between the rates of change in producer prices and import prices (Chart 2).

Our study estimates the effects of imported input price increases on domestic producer prices by manufacturing sectors in Turkey. To do that, we include USD-denominated import prices and the USD/TL exchange rate, the key drivers of higher input prices, as two separate variables in our analysis. As a matter of fact, Yüncüler (2011), Kara and Öğünç (2012), Özmen and Topaloğlu (2017) have shown that the degree and speed of the pass-through to prices might be different for import prices and exchange rates and, thus, decomposing these effects can enrich the information content. Lastly, we compare the pass-through coefficients calculated for each of these variables with the intensity of sector-level imported input use, and then examine if the degree of pass-through effects is proportional to their shares in cost.

Study Method

We use a Vector Autoregression (VAR) model to empirically estimate the pass-through effects. The variables are USD-denominated import prices, the USD/TL exchange rate, the output gap and the D-PPI. The model is estimated separately for each sector using monthly data between 2010:01 and 2017:12.

Findings

Our estimation results show that the long-term pass-through coefficients for import prices and exchange rates differ drastically across industrial sectors. The import price pass-through coefficient may reach as high as 70 percent, while the exchange rate pass-through can range from 5 to 107 percent. The manufacture of coking coal and refined petroleum products has the highest values for both pass-through coefficients. It also has the highest intensity of imported input use.

The degree of diversification in the pass-through of import prices and exchange rates across sectors seems to be positively related to the intensity of imported input use (Chart 3). Given only the cost channel, the pass-through of both the exchange rate and USD-denominated import prices should be proportional to the share of imported inputs in total cost. The results have shown that the pass-through from import prices has a linear relationship with the use of imported inputs, whereas the exchange rate pass-through is higher than the share of imported input use.

As shown in Chart 3, the exchange rate pass-through is much higher than the import price pass-through in many sectors. This can be attributed to the presence of factors other than production costs, such as FX liabilities and investment costs, which affect pricing and a firm’s balance sheet. Moreover, the persistence and volatility of shocks are key determinants of the pass-through of cost shocks to prices (Taylor, 2000). In the analyzed period, commodity prices were more moderate than before the financial crisis of 2008. Thus, another reason for the higher exchange rate pass-through in comparison to the import price pass-through could be the gradual weakening of the Turkish lira, especially with the heightened uncertainty about global monetary policies after May 2013 when the US Federal Reserve signaled a tapering of its asset purchases. Lastly, the level of competition and the resulting profit margins are among other factors that may affect this relationship. In sum, the findings reveal that exchange rates affect inflation not only through the cost channel but also through expectations, type of financing, market structure, etc.

Conclusion

To sum up, in this study, we have found that domestic producer prices are more likely to be exposed to exogenous shocks as the use of imported inputs increases. Estimations based on input/output tables show that the use of imported inputs has increased over years in the Turkish manufacturing industry. This suggests that the cost pressure from exchange rates and import prices has intensified over time. Adopting policies to reduce the share of imported inputs is critical to narrowing the structural current account deficit as well as to enhancing the effectiveness of monetary policy and creating more room for maneuver to fight against inflation.

[1] See Mihaljek and Klau (2008).

References

Ahn, J., Park, C. G. ve Park, C. (2016). Pass-through of imported input prices to domestic producer prices: evidence from sector-level data. The B.E. Journal of Macroeconomics, 17(2).

Auer, R. ve Mehrotra, A. (2014). Trade linkages and the globalisation of inflation in Asia and the Pacific. BIS Working Paper, April 2014.

Kara, H. ve Öğünç, F. (2012). Döviz kuru ve ithalat fiyatlarının yurt içi fiyatlara etkisi. İktisat İşletme ve Finans, 27(317), 09-28.

Mihaljek, D. & Klau, M. (2008). Exchange rate pass-through in emerging market economies: what has changed and why? BIS Papers No:35.

Özmen, M. U. ve Topaloğlu, M. (2017). Disaggregated evidence for exchange rate and import price pass-through in the light of identification issues, aggregation bias and heterogeneity, TCMB Çalışma Tebliği Serisi, No. 17/08.

Taylor, J. B. (2000). Low inflation, pass-through, and the pricing power of firms. European Economic Review, 44(7), 1389-1408.

Yüncüler, Ç. (2011). Pass-through of external factors into price indicators in Turkey. Central Bank Review, 11(2), 71-84.