Movements in international crude oil prices are among the key determinants of inflation dynamics. Developments in crude oil prices provide an important input for macroeconomic forecasts by way of their direct and indirect implications on inflation and economic activity.[1] It is therefore important for a central bank, targeting price stability as its main objective, to meticulously ascertain projections regarding crude oil prices while making inflation and growth forecasts.

Factors that complicate forecasting crude oil prices …

Price of oil can, to a great extent, be estimated based on supply and demand conditions in the market, since oil is a physical commodity. However, dynamics in the oil market can diversify significantly in time due to driving forces of oil price movements and complicate forecasting of prices.[2] Besides, decisions taken by oil oligopolies can exogenously cause fluctuations in crude oil prices.[3] In addition to the movements in oil supply and demand, the level of oil stocks along with the changes therein also play an instrumental role in oil price dynamics (Chart 1).[4]

What is more, crude oil nowadays has increasingly been used as a financial asset. “Financialization” of the oil market also prompts prices to react more rapidly to macroeconomic news and the volatility can show significant increases from time to time as shown in Chart 2.

All these factors restrain the performance of forecasts made using theoretical or standard empirical models. Then, let me mention a little bit of what type of tools/methods are in use for a more accurate forecast of oil prices.

Using futures prices to forecast crude oil prices …

Futures prices are the most commonly-used tool to make crude oil price projections. Futures market prices have relative advantages. First, the slope of yield curves formed with these prices[5] provides information on the direction of spot prices. Moreover, by being very simple, transparent, easily accessible and readily understandable for the market, futures prices shine out as a loud and clear source that can be resorted to while forming an assumption set. Therefore central banks and international agencies frequently use futures prices on the crude oil market while making forecasts.

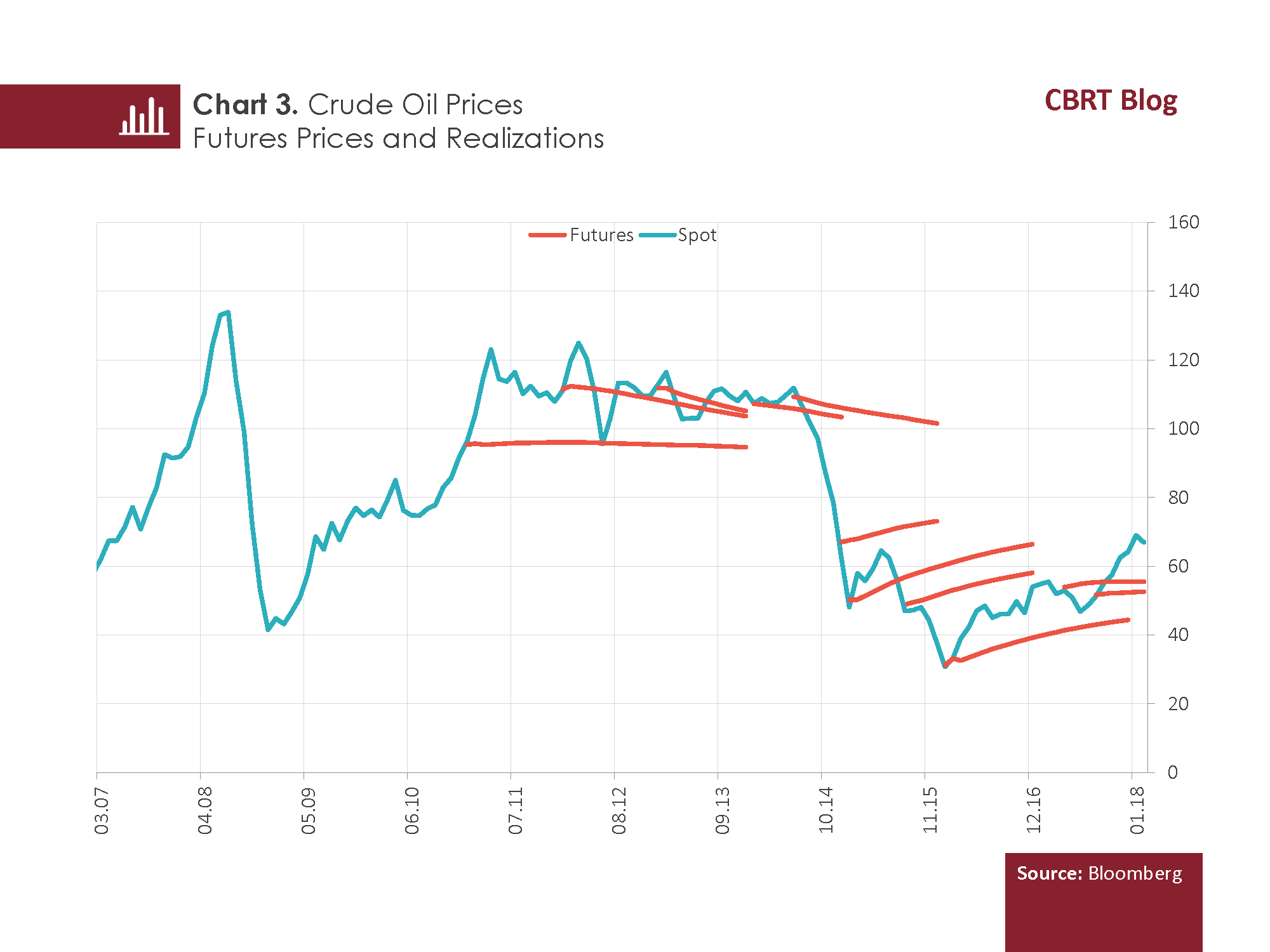

Despite such a wide-spread use, it is noteworthy that crude oil futures prices generally fall short of forecasting spot prices. As a matter of fact, Chart 3 shows that futures prices underperform in forecasting spot prices.

It should of course be noted that crude oil is a storable commodity. That is, the spot price implies both the current supply and demand conditions, and expectations of future supply and demand.[6] Therefore, it would not be so surprising to see that the slope of futures price yield curves is almost flat.[7] That is to say, while futures prices perform better in forecasting crude oil prices during periods of relatively stable prices, they fail more in times of increased volatility.

Different forecasting methods…

Due to the low forecast accuracy of futures prices, various central banks and academics have resorted to different estimation methods to improve crude oil price forecasts.

In 2005, MacCallum and Wu from the Federal Reserve Bank of San Francisco compared the performance of prices formed in futures markets to the forecasts obtained by using the methods of random walk, consensus forecasts[8], crude oil forecasts made according to Hotelling’s model, and futures-spot spread modelling. They concluded that forecasts made by using these methods do not statistically differ from the forecasts implied by futures prices. Nixon and Smith also reached similar conclusions in a similar study they conducted in 2012 at the Bank of England.

A study[9] conducted by the International Monetary Fund in 2011, compared the performance of various econometric approaches[10] in forecasting commodity prices. Although the study aimed to adopt a holistic approach with the inclusion of the slope of futures price yield curves[11] and of conditions peculiar to the commodity market in the analysis, no significant difference was found in the forecasting ability. Concerning the out-of-sample forecast comparison that gains importance particularly from policymakers’ standpoint, the study concluded that it was quite hard to outperform futures markets’ forecasts.

A study dated 2011 by the Fed presented a quite comprehensive overview regarding methods for forecasting crude oil prices.[12] This study suggested that the key issue in forecasting crude oil prices was the selection of the base period for the forecast due to the changing nature of oil market dynamics. However, this approach, naturally, does not improve the out-of-sample forecasting performance, which is of critical importance for central banks. Yet, the study noted that structural VAR models significantly increase the out-of-sample forecasting performance and what is more, such models constitute a useful tool to study alternative scenarios and to make risk assessments that are all critical to central banks. Based on this, in 2016, Jin estimated crude oil prices with time-varying parameters[13] by using the unobserved components model and argued that inclusion of changing market conditions in the process largely improved the forecasting performance.

In 2014, the European Central Bank conducted a study[14] reporting the results of nine different models with the aim of improving out-of-sample forecasting performance for crude oil prices and using it in macro estimations. Forecast performance of futures prices is compared to the performances of the VAR and BVAR models as well as DSGE models that include macroeconomic relations in an interactive fashion, in addition to the basic models such as random walk. An evaluation of the models, individually, suggested that their forecasting capacity could not outperform that of futures prices. Another finding of the study was that as dynamics of the oil market show significant variations in time, a single model falls short of outperforming the others in explaining the dynamics within a certain time frame. Meanwhile, the study revealed that a concurrent combination of all models used in forecasts increase the forecasting performance for all time horizons.

We also reached similar conclusions in our studies at the CBRT.[15] When we compared the performance of futures prices with the performance of random walk as well as the performance of monthly and quarterly models based on economic theory, we found that none of the methods managed to outperform the other in neither cases.[16] Besides, we found that while in-sample forecast errors of each model separately were quite low, the real -time forecasting performance -crucial for macroeconomic analyses- deteriorated significantly, and that the constant price assumption gave the lowest forecast error when we compared real-time forecasting errors. In brief, despite the “weak” performance of futures prices in oil price forecasting, defending the stand-alone performance of alternative models is also quite out of the question. Nevertheless, we observed a significant improvement in the accuracy of forecasts made by using a concurrent combination of forecasting models.

What, then, do all these imply?

To conclude, by being simple, transparent and easily accessible, prices on futures markets generally serve as a good starting point for forecasting oil prices, yet it is safe to say that forecasts made using a proper combination of different methods give more reasonable results.[17]

[1] Crude oil prices affect inflation directly through energy prices and indirectly through production costs. They also have an impact on production by changing consumption and investment expenditures by way of disposable income.

[2] See Manescu and Van Robays, (2014).

[3] See Currie et al. (2010).

[4] For instance, a new technology called “shale oil extraction” brought about a recovery in crude oil production that had been on the decline in the US from 70s to 2009. As a result, OPEC, starting to lose its share in the market, withdrew its price policy and embarked on a new policy to preserve its market share and started to increase supply.

[5] Expectations regarding commodity futures prices are of great importance in the determination of spot prices, dependent on the storability of the commodity. The convenience yield between physically possessing a commodity and having a futures contract for that commodity determines the differentiation between spot and forward prices. If commodity stocks are scarce, the merits of physically possessing the commodity increase compared to having a forward contract, leading to a wider spread between forward prices and spot prices.

[6] This is explained rather by the arbitrage between spot and forward prices. For any price expectation pertaining to a future period, market participants adjust their positions in such a way as to converge the expectations of a spread between current and future prices to the market return (adjusted according to storage or sales costs).

[7] See: Reeve and Vigfusson, (2011).

[8] Likewise, Alquist and Kilian (2010) and Alquist et al. (2011) also reported that survey-based forecasts were more biased and had higher error probability in forecasting compared to forward prices.

[9] See Reichsfeld and Roache, (2011).

[10] Forecasts derived by using random walk, ARIMA, error correction model, and level forecasting model with lagged value were compared with those derived from futures prices.

[11] Either backwarded (slope is downwards) or contango (slope is upwards).

[12] See Alquist et al., (2011).

[13] Kalman filter.

[14] See Manescu and Van Robays (2014).

[15] See Aktaş and Tuğer (2017).

[16] The time horizon in Import Unit Value Index modelling starts with the beginning of 2010 in order to disregard the effects of the period in which the global financial crisis prevailed. For monthly and quarterly-designed models, the “stepwise least squares” method was preferred for forecasts.

Method for model selection: Stepwise forward. In this method, each variable is chosen individually, variables are ranged from the lowest p-value (the null hypothesis - the coefficient is zero) to the highest p-value and the variables above a certain criteria are excluded from the equation. As variables are tried one by one, the issue of low “degrees of freedom” is not likely to arise. Stopping criteria forward p-value = 0.01

[17] See Manescu, C. and Van Robays (2014), Aktaş and Tuğer (2017).

Bibliography:

Aktaş Z. and B. Tuğer (2017). “Info on Updating the Forecasting of Import Unit Value Index”, CBRT information note for internal use.

Alquist R. and L. Kilian, (2010). “What do we learn from the price of crude oil futures?”, Journal of Applied Econometrics, February, No:25, pages 539-573.

Alquist R., L. Kilian and R. J. Vigfusson, (2011). “Forecasting the Price of Oil”, Board of Governors of the Federal Reserve System International Finance Discussion Papers, July, No: 1022.

Currie J., A. Nathan, D. Greely and D. Courvalin, (2010). “Commodity Prices and Volatility: Old Answers to New Questions”, Goldman Sachs Global Economics Paper, March, No:194.

Jin, X., (2016). “Does the Future Price Help Forecast Spot Price?”, University of Aberdeen Business School Discussion Papers in Economics, June, No: 16-8.

McCallum A. and T. Wu, (2005). “Do Oil Futures Prices Help Predict Future Oil Prices?”, Federal Reserve Bank of San Francisco Economic Letter, No: 2005-38.

Manescu, C. and I. Van Robays, (2014). “Forecasting the Brent Oil Price Addressing Time Variation in Forecast Performance”, ECB Working Paper Series, September, No: 1735.

Nixon D. and T: Smith, (2012). ‘What can the oil futures curve tell us about the outlook for oil prices?’, Bank of England Quarterly Bulletin, 2012-Q1.

Reeve T. A. and R. J. Vigfusson, (2011). “Evaluating the Forecasting Performance of Commodity Futures Prices”, Board of Governors International Finance Discussion Papers, August, No: 1025.

Reichsfeld D. A. and S. K. Roache, (2011). “Do Commodity Futures Help Forecast Spot Prices?”, IMF Working Paper, No:11/254.