Governor Erdem Başçı's Speech at the Briefing on Inflation Report 2015-I (Ankara, 27/01/2015)

Distinguished Guests,

Welcome to the briefing held to convey the main messages of the Inflation Report of January 2015.

We have been pursuing a cautious monetary policy stance for a year. We have witnessed some favorable outcomes of this approach. The downward trend in inflation will accelerate starting from this month. Therefore, we began cutting policy rates in January. Provided we maintain our cautious approach throughout these policy rate reductions, the end-2015 inflation will likely be the lowest we have seen in the last 45 years. I will now present an overview of the report, which will be published on our website soon.

The report typically summarizes the economic outlook underlying monetary policy decisions, shares our evaluations on macroeconomic developments and presents our medium-term inflation forecasts, which were revised in view of the developments in the last quarter, along with our monetary policy stance. In addition to the main text, the report includes seven boxes entailing interesting and up-to-date analyses on various topics. The report presents boxes that analyze the effects of oil prices on consumer prices and the reflection of international grain prices on domestic prices. Moreover, there are studies elaborating on the role of base effects on consumer inflation in 2015, the debt dollarization of companies in Turkey and their growth performance, the macroeconomic effects of international energy prices and the reverberations of remuneration of required reserves. Titles of the boxes are shown on the slide. All of these analyses shed light on noteworthy issues in the Turkish economy. I strongly recommend that you read these boxes, which will soon be published on our website.

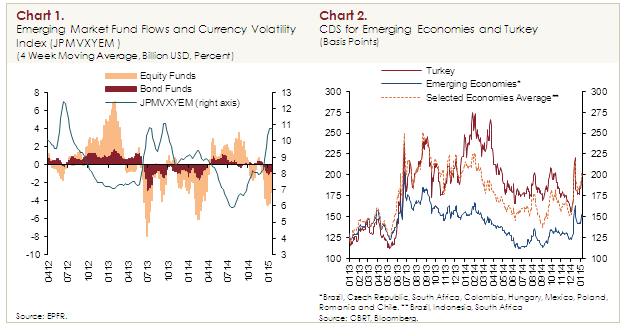

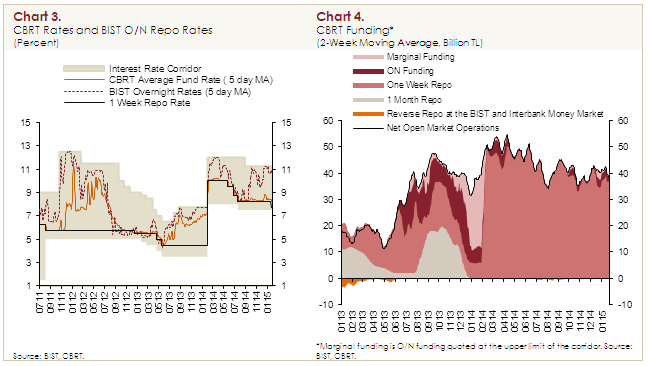

I would like to commence my speech by reviewing the global economic outlook given its undeniable influence on our policies. In the fourth quarter of 2014, due to the persisting divergence among global monetary policies besides uncertainties regarding the normalization process, we saw aggravated volatility in financial markets. This led the portfolio flows towards emerging economies to fluctuate and the volatilities of exchange rates in these countries to increase (Chart 1). The persisting deterioration in global economic activity accompanied by mainly supply-side factors has recently pulled down oil prices sharply. These developments caused considerable fluctuations especially in energy-exporting emerging countries. Overall, the risk premia of emerging economies followed a volatile course due to the monetary policy uncertainties, the slowdown in economic activity and the course of oil prices (Chart 2).

Effects of this volatility in global markets emerged in the Turkish economy as fluctuations of risk premium indicators and exchange rates. The fall in commodity prices, chiefly in oil, is expected to improve the economy especially in terms of inflation and external balance. Additionally, the tight monetary policy stance stands out as a factor that limits the negative effects of global volatilities on Turkey in this period.

Annual growth recorded some deceleration following the first quarter of 2014. This was mainly led by receding agricultural output amid unfavorable climatic conditions as well as the slowdown of export growth resulting from geopolitical risks. Indicators regarding the last quarter show that annual growth remained moderate due to weak foreign demand. In 2015, we expect the growth rate to increase gradually with the increased contribution of domestic demand.

The positive effects of the tight monetary policy stance and macroprudential measures continued in the last quarter of 2014 leading the core inflation trends to approach the target. Moreover, plummeting oil prices supported the disinflation process and inflation expectations have recently seen a noticeable improvement. Due to the fading cumulative effects of the exchange rate, the reverting of food inflation to past years’ averages as well as the falling oil prices, we project a notable decline in inflation in 2015. Accordingly, inflation is estimated to approach the levels consistent with the target in mid-2015.

1. Monetary Policy and Financial Conditions

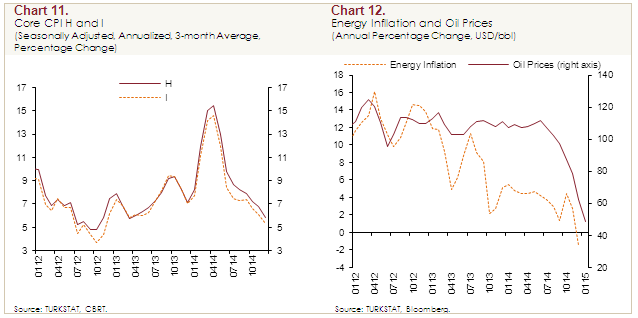

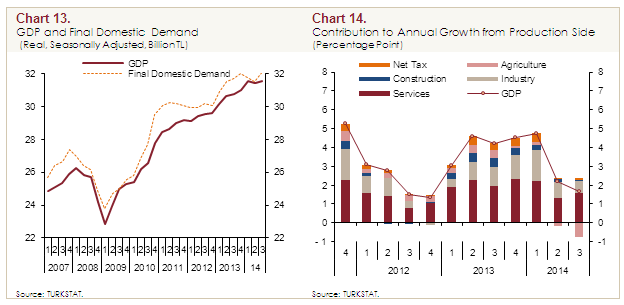

The Central Bank of the Republic of Turkey (the CBRT) maintained its tight stance in the last quarter of 2014 and in consideration of global volatilities, supported the tight monetary policy with a tight liquidity policy. As you can see on the slide, the BIST overnight repo rates have remained close to the upper bound of the interest rate corridor since October in line with the liquidity policy (Chart 3). The CBRT funding has been made mainly through one-week repo auctions since early 2014 (Chart 4). Thus, the CBRT average funding rate hovered around the 1-week repo rate in this period.

As we all know, core inflation trends are following a downward trend. Considering the fall in oil prices and improved expectations that result in favorable developments in the inflation outlook besides this downward trend in the core inflation trend, we decided on a measured cut in the 1-week repo rate from 8.25 percent to 7.75 percent in January. On the other hand, given the elevated volatility in global markets, we kept overnight rates unchanged and announced through the MPC Decision that we would adopt a cautious stance to render the decline in inflation permanent. In this context, we emphasized that we would closely monitor inflation expectations, the pricing behavior and other factors affecting inflation and maintain the tight monetary policy stance by keeping the yield curve flat until the there is a significant improvement in the inflation outlook. Owing to this stance, the spread between 5-year market rates and the BIST Interbank Overnight Repo Rates continues to take negative values (Chart 5). Along with these developments, the yield curve has remained almost flat (Chart 6).

We announced the outline of the monetary and exchange rate policy for 2015 through a press meeting on 10 December 2014. We also launched new macroprudential policies to limit macro-financial risks and to support prudential borrowing at this meeting. In this scope, to encourage the extension of maturities of external borrowing, we raised the required reserve ratios applied to non-core foreign exchange (FX) short-term liabilities of banks and financing companies. Additionally, we embarked on the remuneration of TL required reserves to encourage core liabilities in January 2015. Moreover, we implemented technical adjustments in reserve option tranches and coefficients to meet the FX liquidity to be required due to the changes in required reserve ratios. We envisage that the automatic stabilization feature of the Reserve Option Mechanism (ROM) will gain strength with these adjustments. Through these policy measures we announced, our final aim is to limit macro-financial risks and contribute to balanced growth by supporting prudential borrowing.

The rate of increase in the loans extended to the non-financial sector in the last quarter of the year maintains a reasonable course owing to the CBRT’s tight monetary policy stance and the macroprudential measures. Supported also by the actions of the Banking Regulations and Supervision Agency (the BRSA), consumer loans grew slower than past years, while commercial loans displayed a higher rate of increase (Charts 7 and 8). According to the current financial conditions and the results of the Loan Tendency Survey, there has not been any noticeable change in demand and supply conditions in commercial and consumer loans in the first quarter of 2015. Accordingly, we envisage that credit growth will maintain its current trend in the upcoming period. These reasonable levels in credit growth are expected to continue to limit medium-term inflation pressures on the one hand, and support the improvement in the current accounts balance on the other.

2. Macroeconomic Developments and Main Assumptions

Now, I will talk about the macroeconomic outlook and our assumptions on which our forecasts are based. First, I will summarize the recent inflation developments, and then continue with the domestic and foreign demand outlook.

In the fourth quarter of 2014, annual consumer inflation posted a quarter-on-quarter decline by 0.7 points and stood at 8.17 percent remaining below the forecasts of the October Inflation Report (Charts 9 and 10). Annual inflation decreased across sub-groups in this period, the most remarkable slowdown being in the energy group, which was led by the plunge in international oil prices. The food group remained as the largest contributor to inflation. Core goods registered a slight fall in annual inflation, while the improvement in the underlying trend, which continued from the second quarter on, halted. Meanwhile, we witnessed the considerable effect of the fall in oil prices on fuel-related services and saw a notable improvement in the underlying trend of services.

The tight monetary policy stance coupled with the macroprudential measures continues to improve the core inflation trend (Chart 11). As of the end of 2014, the core inflation trend has receded to 5 percent. The leading recent development, which affected inflation dynamics at most, has been the plunge in oil prices (Chart 12). Amid this decline, annual inflation in the energy group fell remarkably and stood below zero at the year-end. Favorable cost developments driven by plummeting oil prices also contribute to the improvement in the core inflation trend.

Briefly, the last quarter of the year was marked by evident effects of the falling oil prices on inflation. A remarkable improvement was witnessed in inflation expectations after a long period and the positive effect of oil prices on the headline inflation spilled over into many sub-groups, chiefly the services group. Besides the international price developments that contribute to falling inflation, we envisage that the gradual elimination of cumulative exchange rate effects, the decline in food inflation to past years’ averages and our tight monetary policy stance will support the disinflation process in the upcoming period. Against this background, we project that consumer inflation will register a notable improvement particularly in the first quarter, and inflation will recede to levels consistent with the target in mid-2015.

Now, I would like to give a brief account of developments in economic activity and the short-term outlook on which the inflation forecasts are based. According to the GDP data of the third quarter of 2014, economic activity was relatively weaker compared to the outlook presented in the October Inflation Report. In the third quarter, the GDP rose by 1.7 percent on an annual basis, while growth remained limited compared to the previous quarter with 0.4 percent (Chart 13). Analysis of national income components on the production side indicates that the contraction in agricultural value-added led by adverse weather conditions is an important factor in the low growth of the national income (Chart 14). Data on the expenditures side reveal that in the third quarter, final domestic demand compensated for the fall in the first half and stood slightly above its level in the last quarter of 2013 (Chart 13). Following an interval of two quarters, private consumption expenditures recorded a robust recovery. In addition, the languishing trend in private investments, which lasted for a long time, reversed due to the increase in machinery and equipment investments. These two factors supported quarterly growth. However, the relatively weak course of exports limited the growth in this period.

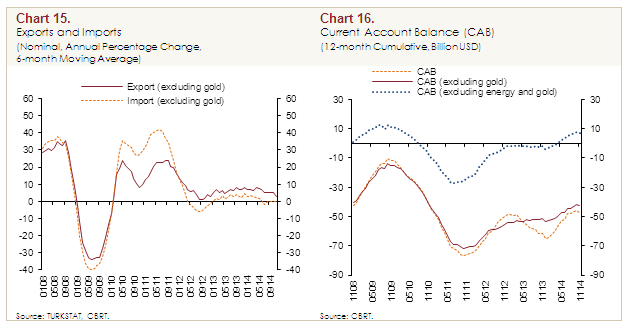

We expect industrial production, which fell below its previous-quarter average during October-November 2014, to decrease on a quarterly basis in the fourth quarter in line with the decline in December’s PMI and BTS survey indicators. Yet, data for the fourth quarter of 2014 point to a quarter-on-quarter pickup in consumer demand, a moderate course in machinery-equipment investments and some recovery in construction investments. Hence, we believe that domestic demand will remain on a modest upward track in the final quarter. External demand, on the other hand, remains weak due to Europe’s slowing economy and geopolitical tensions in neighboring countries. The weak external demand puts pressure on export growth, but the fact that export growth exceeds import growth supports the rebalancing of the economy (Chart 15). Moreover, falling oil prices contribute positively to the current account balance by reducing import expenditures (Chart 16).

We expect domestic demand to recover moderately and external demand to remain weak in 2015. Depending on weather and precipitation conditions, the projected correction in the agricultural value-added will be a factor to support growth. However, there are external demand-driven downside risks to growth. Thus, in 2015, demand conditions will contribute to the disinflation process. Although we expect the growth composition to change in favor of domestic final demand, we believe that the current account deficit will continue to improve on the back of the macroprudential measures and the improved terms of trade.

As you all know, food, energy and import prices also play a great role in inflation forecasts. Therefore, before moving on to forecasts, I will briefly talk about our assumptions regarding these variables.

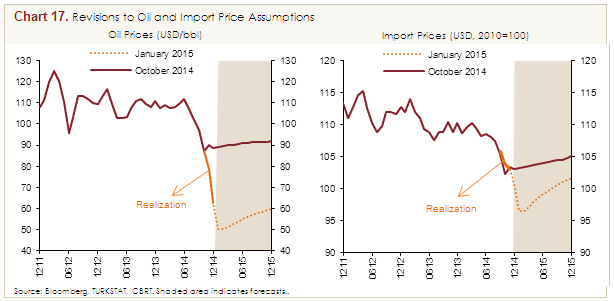

In the fourth quarter of 2014, oil and import prices remained well below the projections of the October Inflation Report (Chart 17). Accordingly, we revised our medium-term assumptions of oil and import prices significantly downwards. In view of the direct and indirect effects of these developments, we revised the end-2015 inflation forecast down by 0.6 percentage points compared to the previous reporting period. In food prices, we left the end-2015 inflation forecast unchanged at 9 percent.

Our medium-term projections are based on the assumption that tax adjustments and administered prices are consistent with inflation targets and automatic pricing mechanisms. The medium-term fiscal policy stance is based on the Medium Term Program projections covering the 2015-2017 period. Accordingly, we assume that a tight fiscal stance will be implemented and the primary expenditures to the GDP ratio will decrease gradually.

3. Inflation and the Monetary Policy Outlook

Now, I would like to present our inflation and output gap forecasts based on the outlook I have described so far.

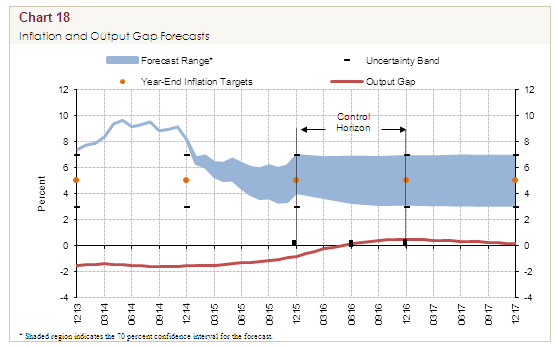

Our medium-term forecasts are based on a framework that we will adopt a cautious approach to make the improvement in inflation outlook permanent and maintain the tight monetary policy stance by keeping the yield curve flat. Moreover, we assess that the annual loan growth rate will stabilize around the recent reasonable levels, also thanks to the macroprudential measures. Accordingly, we expect inflation to be, with 70 percent probability, between 4.1 percent and 6.9 percent (with a mid-point of 5.5 percent) at end-2015 and between 3.2 percent and 6.8 percent (with a mid-point of 5 percent) at end-2016. We project inflation to stabilize around 5 percent in the medium term (Chart 18).

In sum, we revised our end-2015 inflation forecast down by 0.6 points to 5.5 percent from 6.1 percent in the October Inflation Report. This revision is driven by falling oil prices. The projected noticeable decline in inflation compared to 2014 is largely due to falling oil prices as well as our projections that cumulative exchange rate effects will continue to taper off and food price inflation will recede to past years’ averages. The course of inflation in 2015 will be determined by base effects. We expect base effects to pull annual inflation down until August and push it up the rest of the year. Thus, we project that annual inflation will remain on a downward track until the third quarter and increase slightly to 5.5 percent due to base effects in the fourth quarter (Chart 18).

In addition to these forecasts, we discuss alternative scenarios on the inflation outlook and the global economy in the Risks section of the Inflation Report. You can examine the Report for details.

While concluding my remarks, I would like to thank all my colleagues who contributed to the Report, primarily those at the Research and Monetary Policy Department as well as the members of the Monetary Policy Committee, and thank every one of you for your participation.