Governor Erdem Başçı's Speech at the Briefing on Inflation Report 2015-II (İstanbul, 30/04/2015)

Distinguished Guests,

Welcome to the briefing held to convey the main messages of the Inflation Report of April 2015.

The report typically summarizes the economic outlook underlying monetary policy decisions, shares our evaluations on macroeconomic developments and presents our medium-term inflation forecasts, which were revised in view of the developments in the last quarter, along with our monetary policy stance. In addition to the main text, the report includes eight boxes entailing interesting and up-to-date analyses on various topics. The boxes present the effects of the supply chain and fuel prices on fresh fruit and vegetable prices, the cost structure of firms and cost-oriented inflationary pressures, and the reflection of parities and energy prices on non-gold export and import prices. Moreover, there are studies elaborating on the minimum wage and the distribution of wages, the flow dynamics of unemployment in Turkey, the export decisions of firms, and Turkey’s convergence experience. Titles of the boxes are shown on the slide. All of these analyses shed light on noteworthy issues in the Turkish economy. I strongly recommend that you read these boxes, which will soon be published on our website.

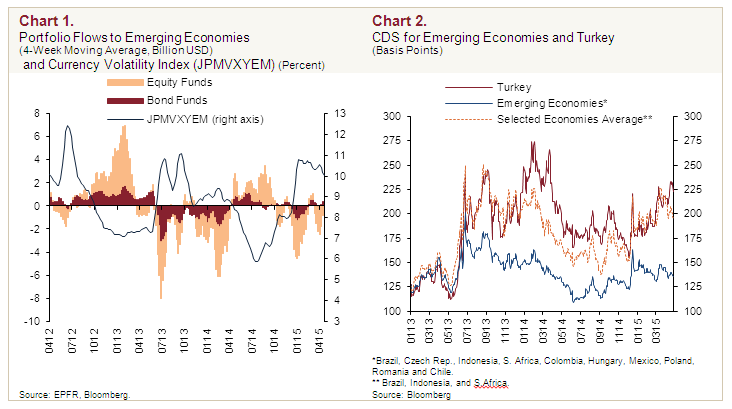

I would like to commence my speech by reviewing the global economic outlook, given its undeniable influence on our policies. The first quarter of 2015 was marked by the ongoing turbulence in global financial markets, which was attributed to the continued divergence among global monetary policies, the uncertainties over the normalization process and the feeble economic activity. In this context, portfolio flows to emerging economies remained weak and the volatility of exchange rates increased (Chart 1). Similarly, emerging market risk premiums exhibited a fluctuating pattern (Chart 2). In this period, global economic activity remained weak. Growth rates in emerging economies started to slow down following the fast recovery after the global financial crisis, recording the lowest levels in the post-crisis period as of 2014. Looking at advanced economies, the US economy continues to perform relatively strong, while growth in the EU is still weak despite the limited recovery in economic activity in the last quarter of 2014. Leading indicators regarding the first quarter of 2015 signal a limited improvement in global economic activity. Moreover, the EU economy, which is crucial for the external demand for Turkish exports, has shown signs of recovery.

Volatility across global markets had implications for the Turkish economy as well, causing fluctuations in risk premium indicators and exchange rates. We believe that this period of heightened global uncertainty poses several opportunities and challenges for the Turkish economy. Falling commodity prices help to improve inflation and the external balance by affecting input costs positively. Additionally, the increase in disposable income driven by declining energy prices is likely to support growth. Low levels of long-term interest rates are also contributing positively to the economy. In an environment of low global interest rates, extending the maturities of external debt and supporting prudential borrowing will strengthen financial stability. However, the weak global economy weighs on growth by restraining exports. Moreover, the high volatility in the euro/dollar parity caused by the divergence among monetary policies may have an adverse effect on the export outlook owing to Turkey’s external demand composition.

Our annual growth saw some deceleration in 2014. On the production side, the supply-related contraction in the agricultural value-added was a factor in this slowdown. On the expenditure side, net exports were the main contributor to growth. Thus, the current account balance improved substantially in 2014. Data released for the first quarter of 2015 point to a loss of pace in economic activity driven by both domestic and external demand. We expect economic activity to display a moderate and gradual recovery following the sluggish first quarter.

The positive effects of our cautious monetary policy stance and macroprudential measures helped core inflation indicators improve further in the first quarter of the year. High food inflation, however, was the key factor delaying the decline in consumer inflation. The inflation outlook has somewhat deteriorated due to cost pressures, yet we believe that disinflation will resume due to the cautious monetary policy stance and a likely correction in food prices.

1. Monetary Policy and Financial Conditions

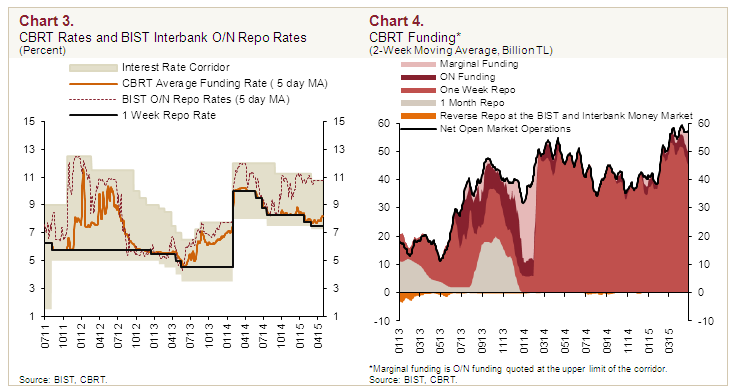

In the first quarter of 2015, the Central Bank of the Republic of Turkey (CBRT) implemented measured cuts in interest rates and maintained its cautious monetary stance by employing a tight liquidity policy (Chart 3). In view of the improved core inflation indicators, we lowered the one-week repo auction rate from 8.25 percent to 7.75 percent in January and later to 7.5 percent in February. Moreover, we lowered overnight borrowing and lending rates by 50 basis points each in February. We kept rate cuts modest in January and February due to the ongoing global uncertainty, volatile energy prices, rising domestic food prices and the relatively high levels of inflation expectations. The CBRT average funding rate has been slightly above 7.5 percent due to the recent liquidity policy implementation.

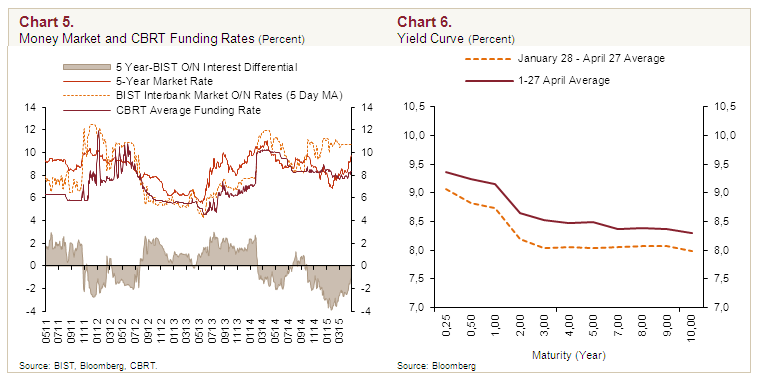

We stated that uncertainty in global markets and elevated food prices necessitated implementing a cautious monetary stance. Thus, we emphasized that we would closely monitor inflation expectations, pricing behavior and other factors that affect inflation and maintain the cautious monetary policy stance until there is a significant improvement in the inflation outlook. Given this outline, we kept our tight monetary stance (Chart 5). Thus, the yield curve has remained nearly flat (Chart 6).

As you all know by now, we have taken several measures regarding foreign exchange liquidity due to the recently heightened volatility in exchange rates. Starting from 27 February 2015, we set the amount of foreign exchange selling auctions more flexibly. On 10 April, we announced that on days when deemed necessary the FX selling auction amount might be increased by up to USD 30 million above the pre-announced minimum amount. Additionally, on 10 March 2015, in order to meet the temporary foreign exchange liquidity needs of the banking sector and to reduce the TL-denominated intermediation costs, we made some technical adjustments to different tranches of the reserve option coefficients. Again, to this end, we raised the remuneration rate for the required reserves maintained in Turkish lira by 50 basis points at the Monetary Policy Committee (MPC) meeting in April, effective as of the 8 May 2015 maintenance period.

Moreover, in order to lessen macro financial risks and to support prudential borrowing, we raised the required reserve ratios applied to non-core FX short-term liabilities of banks and financing companies to encourage banks to extend the maturities of external borrowing. In addition, in view of global interest rate developments, we reduced the rates applied to banks’ one-week maturity FX borrowings from the CBRT on 9 March and 22 April 2015. Accordingly, we lowered the one-week FX deposit interest rate, which was 7.5 percent for USD and 6.5 percent for EUR before early March, to 4 percent for USD and 2 percent for EUR as of 24 April.

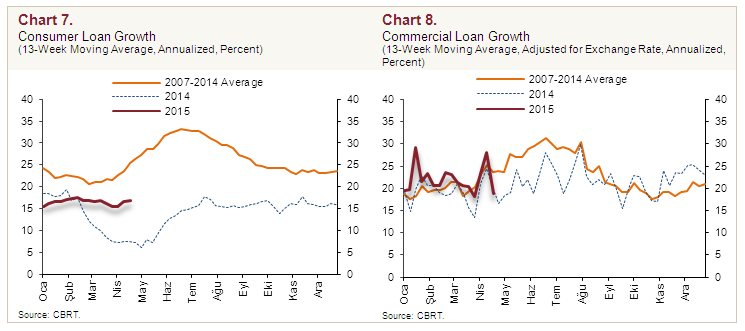

As you can see on the slide, thanks to our tight monetary policy stance and macroprudential measures, the loans provided to the nonfinancial sector continued on a moderate course in the first quarter of 2015. Adjusted for exchange rate changes, loans provided to the nonfinancial sector increased by 17.6 percent year-on-year and by 16 percent based on annualized 13-week moving averages that cover the first quarter of 2015. Although annual loan growth may increase slightly in the short term, due to the weak base from the past year, we expect no acceleration for the underlying trend and loans will keep growing at a reasonable pace given the modest course of financial conditions. A comparison of consumer and commercial loans shows that commercial loans continue to grow more rapidly than consumer loans. The annualized growth rate of commercial loans moved closer to the 2007-2014 average towards the end of the first quarter of 2015, whereas the annualized growth rate of consumer loans remained below the 2007-2014 average (Charts 7 and 8). The macroprudential policies in recent years have helped to bring the credit expansion rate to sustainable levels and to direct the loan composition towards encouraging production rather than consumption. In this sense, we see that the faster growth rate of commercial loans contributes to both the rebalancing process and to financial stability.

2. Macroeconomic Developments and Main Assumptions

Now, I will talk about the macroeconomic outlook and our assumptions on which our forecasts are based. First, I will summarize the recent inflation developments, and then continue with the domestic and foreign demand outlook.

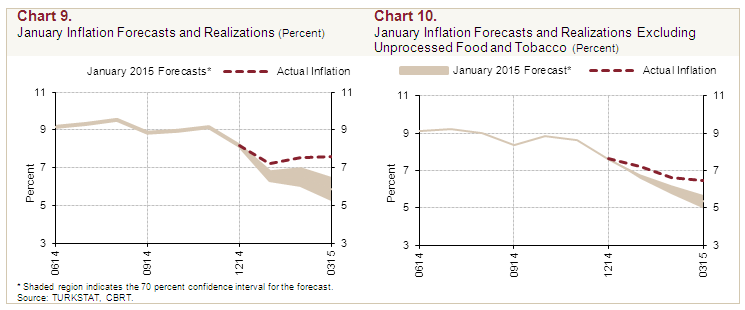

In the first quarter of 2015, annual consumer inflation declined by about 0.6 points from end-2014 to 7.61 percent, overshooting the forecasts of the January Inflation Report (Charts 9 and 10). In this period, core inflation saw a major improvement but the elevated food inflation curbed the fall in annual inflation. Food prices continued to follow an unfavorable course in the first quarter and remained the highest contributor to annual inflation with 3.47 points. After pulling inflation down notably in the fourth quarter of 2014, oil prices started to rise in February, and consequently the positive impact of the energy on inflation has been restrained.

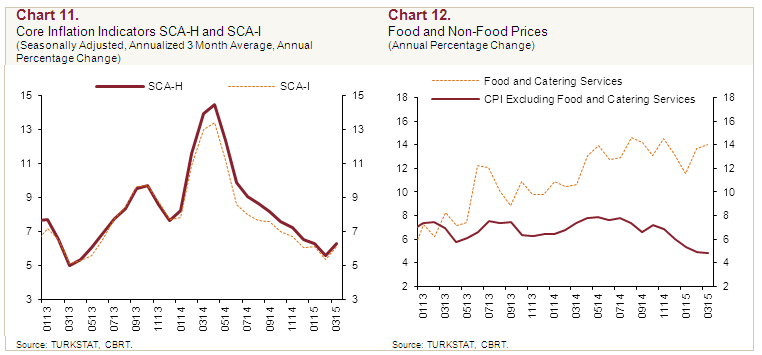

The ongoing cautious monetary policy along with prudent fiscal and macroprudential policies are having a favorable impact on inflation, especially inflation excluding energy and food (core inflation indicators). Accordingly, in the first quarter the underlying trend of core inflation indicators registered a significant quarter-on-quarter improvement (Chart 11). Due to developments in food and oil prices and in TL-denominated import prices in the first quarter, inflationary cost pressures gained some strength compared to the previous period. Yet, our cautious monetary policy stance and the moderate course of domestic demand have contributed to restrain these pressures. High food prices continued to pass through to prices of catering services, bringing the annual food and catering services inflation that accounts for about 30 percent of the consumption basket up to 14 percent as of March. In this period, consumer inflation excluding food and catering services declined further to 4.82 percent (Chart 12).

To sum up, despite the notable improvement in core inflation indicators during the first quarter, rising food prices put a restraint on disinflation. In this period, oil prices and TL-denominated import prices led to cost pressures on inflation. With accommodative weather conditions and possible policy measures, food inflation may have ample room to decline. We expect the measures that the Food Committee (the Food and Agricultural Products Markets Monitoring and Evaluation Committee, founded in December 2014) might suggest will drive food inflation down. Thus, with our ongoing cautious monetary stance and with an outlook of food inflation receding to the average of previous years, consumer inflation is likely to slow further in the second half of the year. Yet, food prices continue to constitute an upward risk on the inflation outlook.

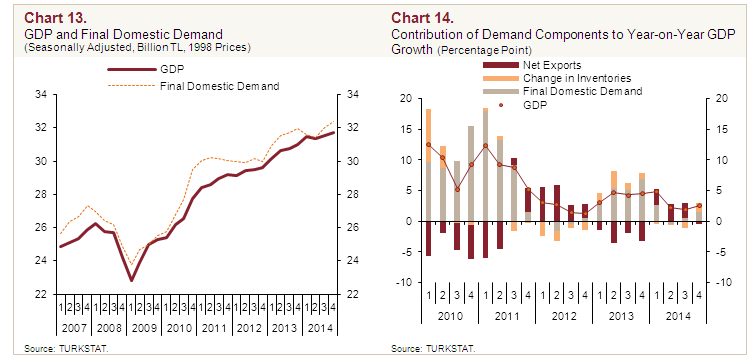

Now, I would like to give a brief account of developments in economic activity and the short-term outlook on which the inflation forecasts are based. According to the Gross Domestic Product (GDP) data for the last quarter of 2014, economic activity was largely consistent with the outlook presented in the January Inflation Report. In the last quarter, the GDP rose by 2.6 percent and 0.7 percent on an annual and quarterly basis, respectively. Real growth stood at 2.9 percent in 2014 (Chart 13). An analysis of national income components on the production side indicates that the contraction in agricultural value-added led by adverse weather conditions lowered the growth rate of 2014. Data on the expenditures side reveal that in the last quarter, final domestic demand rose owing to the increase in private consumption demand as it did in the previous quarter (Chart 14). Across the year, net exports stood out as the leading contributor to growth among the expenditure items.

Data regarding the first quarter of 2015 suggest a weak outlook in economic activity. Industrial production remained unchanged in the January-February period compared to the last quarter of 2014. Among March indicators, the Business Tendency Survey (BTS) and the PMI data also signal that the weak production outlook may continue. External demand remains weak due to slowing global economy and geopolitical tensions. Accordingly, we expect that economic activity will follow a sluggish course in the first quarter of 2015 and then settle into a gradual track of moderate recovery. Downside risks regarding external demand persist due to geopolitical developments, while the signals for recovery in Europe suggest a favorable outlook for exports. On the production side, growth may be boosted by agriculture provided that accommodative climatic conditions increase agricultural added value alongside the base effect caused by the decline in 2014.

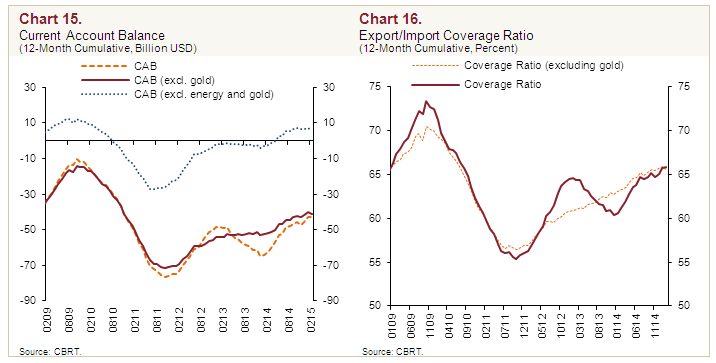

We estimate that the rebalancing in the current account that started in 2011 will continue in 2015. The low levels in the international energy prices cause a notable decline in energy imports and support the foreign trade balance (Chart 15). Moreover, our cautious monetary policy stance and the macroprudential measures bring loan growth rates to plausible levels and improve the loan composition in favor of commercial loans, thus contributing to the rebalancing of the current account deficit. Accordingly, we see that the export/import coverage ratio has been improving significantly (Chart 16).

As you all know, food, energy and import prices also play a great role in inflation forecasts. Therefore, before moving on to forecasts, I will briefly talk about our assumptions regarding these variables.

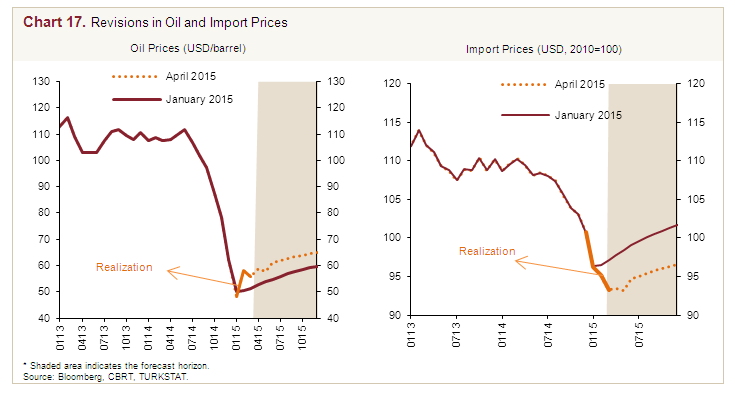

In the first quarter of 2015, oil and import prices remained above our projections, while import prices in USD stood below the path projected in the previous Inflation Report (Chart 17). Accordingly, we revised our assumption for average oil price upwards by 9 percent for 2015, and 5 percent for 2016. Considering the possibility of a correction in food prices, especially one that may stem from unprocessed food, we left the end-2015 food inflation forecast unchanged at 9 percent.

Our medium-term projections are based on the assumption that tax adjustments and administered prices are consistent with inflation targets and automatic pricing mechanisms. The medium-term fiscal policy stance is based on the Medium Term Program projections covering the 2015-2017 period. Accordingly, we assume that a cautious fiscal stance will be implemented and the primary expenditures to the GDP ratio will decrease gradually.

3. Inflation and the Monetary Policy Outlook

Now, I would like to present our inflation and output gap forecasts based on the outlook I have described so far.

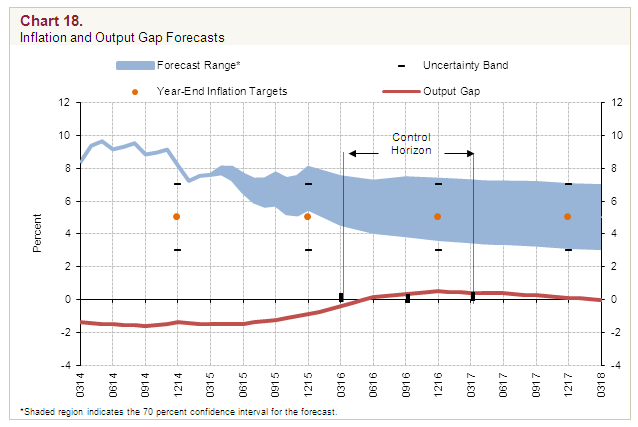

Our medium-term forecasts are based on a framework that a cautious monetary policy stance will be maintained by keeping the yield curve flat until there is a significant improvement in the inflation outlook. Moreover, we envisage that the annual loan growth rate will continue to hover around the recent reasonable levels in 2015, also thanks to the macroprudential measures. Accordingly, we expect inflation will be, with 70 percent probability, between 5.6 percent and 8 percent (with a mid-point of 6.8 percent) at end-2015 and between 3.7 percent and 7.3 percent (with a mid-point of 5.5 percent) at end-2016. We estimate that inflation will stabilize around 5 percent in the medium term (Chart 18).

In sum, we revised our end-2015 inflation forecast, which was presented as 5.5 percent in the January Inflation Report, upwards by 1.3 points (Chart 18). This revision was led by the higher-than-projected oil prices compared to the figures in the January Inflation Report besides the import prices in TL. Accordingly, we estimate that the revision in oil prices and the movements in import prices in TL will push the year-end inflation forecast upwards by 0.4 and 1 point, respectively. The downward revision in economic activity and the output gap, on the other hand, lowered the end-2015 inflation forecast by 0.1 point. Moreover, we revised the end-2016 inflation forecast, which was set as 5 percent in the previous report, upwards to 5.5 percent. We attribute 0.3 point of this revision to the lagged effects of the developments in TL-deominated import prices and 0.2 point to the upward revision in oil prices for 2016.

In addition to these forecasts, we discuss alternative scenarios on the inflation outlook and the global economy in the Risks section of the Inflation Report. You can examine the Report for details.

While concluding my remarks, I would like to thank all my colleagues who contributed to the Report, primarily those at the Research and Monetary Policy Department as well as the members of the Monetary Policy Committee, and thank every one of you for your participation.